In our ever-evolving economic landscape, understanding shifting money management attitudes is crucial for financial companies to keep up. We're excited to share some of the highlights of our latest Logica® Future of Money Study—delving into the financial behaviors of Americans, with a spotlight on Gen Z.

How Americans are Investing and Saving

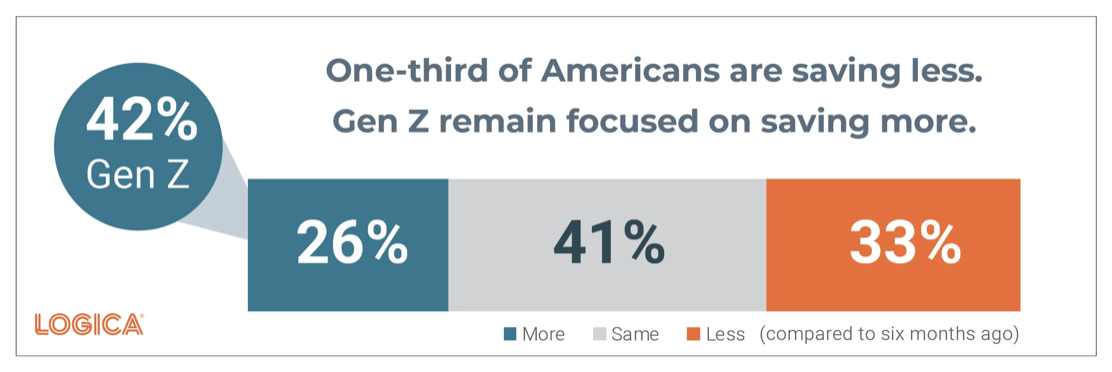

Our Logica® Future of Money Study reveals that the majority of Americans view investing as essential for long-term stability, wealth building, and achieving financial goals. Amid concerns about the current economy, as reported by U.S. News and World Report, there's a heightened desire for stability, driving interest in both investing and saving. Our study shows that while 33% of all generations are saving less in the current economy, 26% are saving more—compared to six months ago. Notably, 42% of Gen Z reports an increase in savings compared to six months ago.

Special Report on Debt

This wave of the Logica® Future of Money Study includes a special report on debt. Nearly two-thirds (63%) of Americans grapple with debt—and are taking on more debt now than earlier in the year—impacting their ability to cover regular expenses and save for the future. This underscores the need for comprehensive solutions in managing debt.