It was 2008.More than eight million Americans lost their homes. Another 10 million lost their jobs. And the S&P 500 cratered 56%.As you know, the source of all this was a collapse in US housing.Between 2006 and 2009, the average home lost over 25% of its value. This shocked millions who bought into the lie that US housing was a “can’t lose” investment.The fallout scarred a whole generation of Americans.

The Last Year Was a Bloodbath in US Homebuilding Stocks

When housing stocks began to slip early last year, investors couldn’t sprint for the exit fast enough.The US Home Construction ETF ITB[BATS] - $35.88 cratered 32% for its worst year since 2008: This was no run-of-the-mill correction.In 2018, homebuilder stocks plunged as much as they had during the first 12 months of the 2008 housing collapse! It was pure panic.But I’m going to explain why it’s a big moneymaking opportunity for us.We’ll buy a company that’s earning record profits while trading at its cheapest valuation since the 2008 financial crisis.It’s the kind of safe but lucrative opportunity you only find in the wake of massive disruption. I also uncovered three other “disruptor” stocks that could double in the next year or so. You can find them here.

This was no run-of-the-mill correction.In 2018, homebuilder stocks plunged as much as they had during the first 12 months of the 2008 housing collapse! It was pure panic.But I’m going to explain why it’s a big moneymaking opportunity for us.We’ll buy a company that’s earning record profits while trading at its cheapest valuation since the 2008 financial crisis.It’s the kind of safe but lucrative opportunity you only find in the wake of massive disruption. I also uncovered three other “disruptor” stocks that could double in the next year or so. You can find them here.Investors Are Fleeing Homebuilders for No Reason

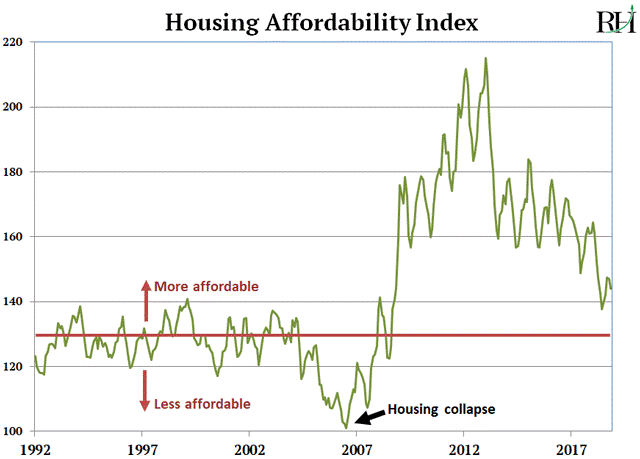

A series of bad news hit homebuilders in 2008.Mortgage rates spiked to reach their highest level since 2011. Trump’s new tax law removed some of the tax incentives for owning a home.And after hitting a 10-year high in November 2017, home sales fell.But one key fact trumps all this negative news: US homes are still very affordable.For proof, let’s look at the National Association of Realtors affordability index.The index takes three key metrics—home prices, mortgage rates, and wages—and boils them down into a single number. This number represents how affordable housing is for the average American.Here’s the index going back to 1992: You can see affordability has dipped from generational highs in the past few years. But it’s still well above the 50-year average as shown by the red line.Over the past half century, the affordability index has averaged 127. Today it’s at 145. The past six years aside, that’s the highest reading since 1971!You see, every housing bust in the past 50 years has happened when affordability was below 120.Put another way, investors are fleeing homebuilder stocks for no reason. The huge selloff is not justified.Data shows that the risk of a housing bust today is virtually zero. Yet many homebuilder stocks are trading at crisis prices!

You can see affordability has dipped from generational highs in the past few years. But it’s still well above the 50-year average as shown by the red line.Over the past half century, the affordability index has averaged 127. Today it’s at 145. The past six years aside, that’s the highest reading since 1971!You see, every housing bust in the past 50 years has happened when affordability was below 120.Put another way, investors are fleeing homebuilder stocks for no reason. The huge selloff is not justified.Data shows that the risk of a housing bust today is virtually zero. Yet many homebuilder stocks are trading at crisis prices!