Financial advisors typically meet face-to-face with their clients at least annually with many meeting as frequently as quarterly. But the pandemic has changed the habits and attitudes of investors regarding these meetings. For most, any meetings in the last six months between financial advisors and their client have been virtual. Will this be the model for the future or will the traditional face-to-face model return?

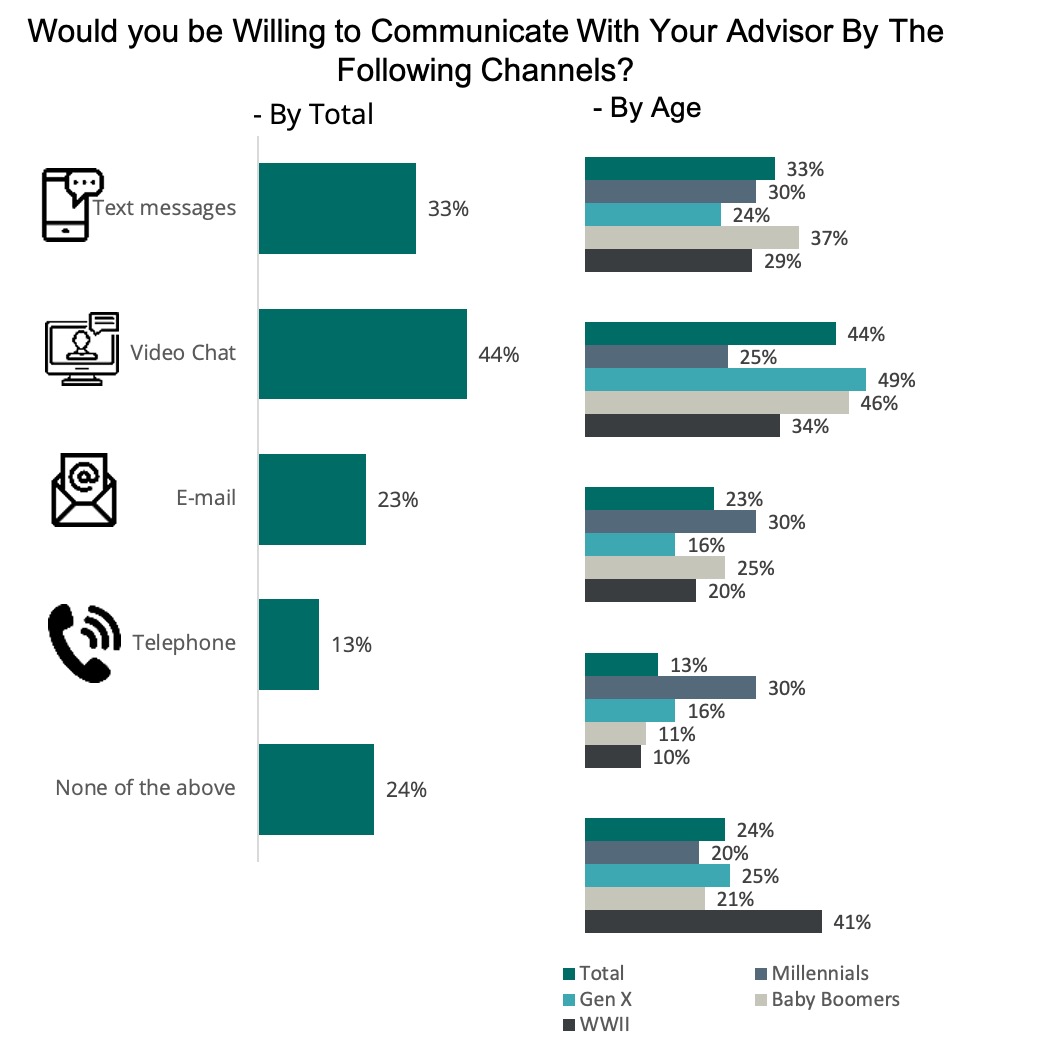

Spectrem’s most recent research with wealthy investors, Communicating Post Pandemic indicates that only 18% of investors communicate with their financial advisor via Video-chat (this includes Zoom, Microsoft Teams, or even Facebook ). Twelve percent indicate that they have increased their interaction via Video-chat since the onset of the pandemic. Yet while there are currently not a lot of investors meeting with their advisor via some type of Video-chat, 44% would be willing to do so in the future.

The increase of Video-chat would not be surprising considering 47% of investors indicate they increased usage of Video-chat with family and friends during the pandemic. Additionally, 32% of investors indicated that over the next year they plan on meeting with their advisor only on a virtual basis.

While many investors will be hesitant in the future to meet with their advisor face-to-face, 62% are willing to meet with their advisor face-to-face - but half of those investors prefer their advisor wears a mask.

So how should financial advisors prepare for the new virtual future?

1. Make sure your advisors are well-trained on how to use virtual platforms. Many investors are still hesitant and nervous about joining a “Zoom call” or other virtual event. Send them the links and information to make the event as easy as possible.

2. Ensure documents and other information are easily accessible. Have advisors practice using virtual technology and conducting meetings to make sure they know how seamlessly move among screens.

3. Have additional help available to assist investors who are struggling. Technology experts should be patient and able to easily explain what investors should be seeing on their screens and guide them through the process.

The new virtual world may ultimately result in many changes. Financial advisors should be prepared with the necessary technology and expertise to make these transitions as successful as possible.

Related: Do Investors Watch Videos Online?