Did you miss our recent “Money Conversations with Zillennials” learning session? Never fear, you can access the quick 30-minute recording here to dig into this important micro-generation that is a blend of Millennials and Gen Zers—born somewhere between the 1990s and early 2000s.

Zillennials, Technology and Money Management

According to The Future of Commerce, this cohort is going to be very comfortable with tech. This was reflected in our recent Logica® Future of Money study, where we found that Zillennials are comfortable using ChatGPT and other generative AI platforms to assist them with their money management. In fact, 64% would use or consider using an AI-based tool for advice on money.

Zillennials and Financial Help

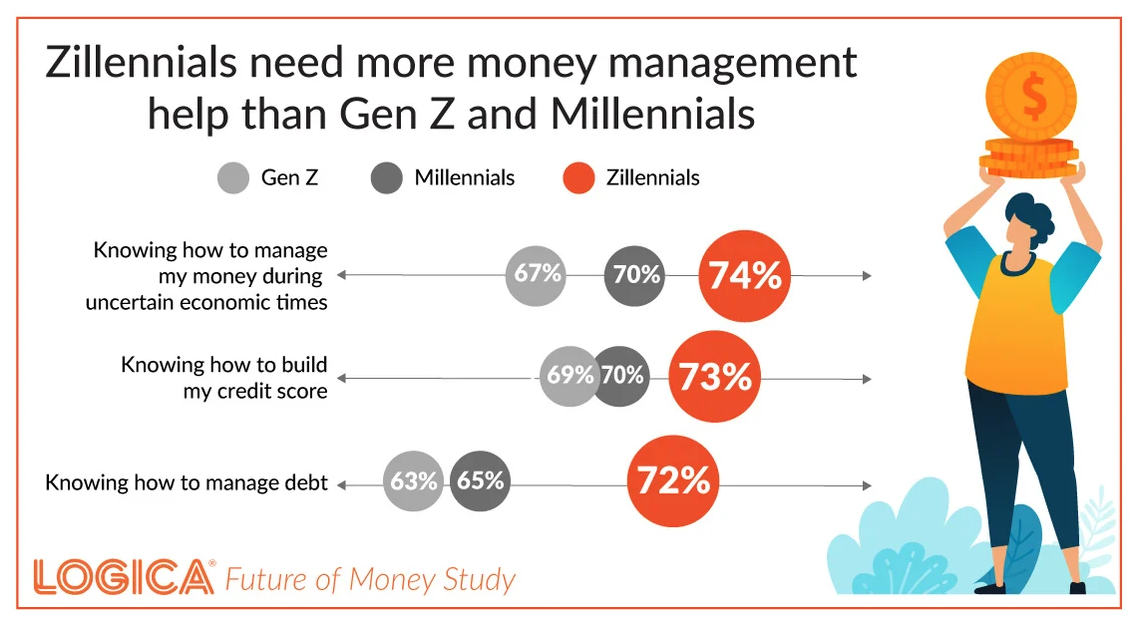

Zillennials are still gaining financial literacy and knowledge, as noted in The Finance Digest. Our study shows that this particular micro-generation needs more help than Millennials and Gen Z (see the graphic above). They are particularly looking for support in “knowing how to manage my money during uncertain economic times” (74%); “knowing how to build my credit score" (73%); and “knowing how to manage debt” (72%). This means they will be looking to various sources to help them manage their finances, and financial companies need to be ready to meet them where they are.

To learn more about Zillennials and money management, you can access our webinar here or reach out to us!