Written by: Roman Chuyan, CFA | Modern Capital Management

In four weeks, 13.4% of the entire US labor force filed for unemployment. A 10% cumulative peak-to-trough GDP contraction is expected this year. If that comes to pass, it would be 2.5 times the size of the 2008-09 economic downturn when US GDP contracted by a cumulative 4%. We have definitely entered the most severe recession in at least 74 years, since 1946 when the manufacturing of war materiel ended in the aftermath of World War II and GDP contracted by 11.6%.

The 2008-09 downturn was called the “Great Recession” as it resulted in tremendous loss of jobs and wealth – an echo of the Great Depression. What will they call this one? We’ve somewhat overused the word “great.” The best I could come up with is the “Immense Recession.” I’m opening a contest for the name, let me know through our website’s contact form!

But stock investors are cheering. The S&P 500 is up 25% since its March-23rd trough – a tremendous split between the grim economic numbers and market action. Optimists point to unprecedented Fed stimulus, the coronavirus curve flattening, and the impending reopening of the economy. They undoubtedly expect a quick, V-shaped recovery from a deep but temporary downturn.

We at Model Capital follow a fundamentals-based approach, and we think that it would be unwise to chase the market up right now. Our fundamentals-based models point for the stock market to back down in the mid-term. It’s been euphoric in the past three weeks, but in its bipolar fashion the market will turn pessimistic once again.

Numbers Focus

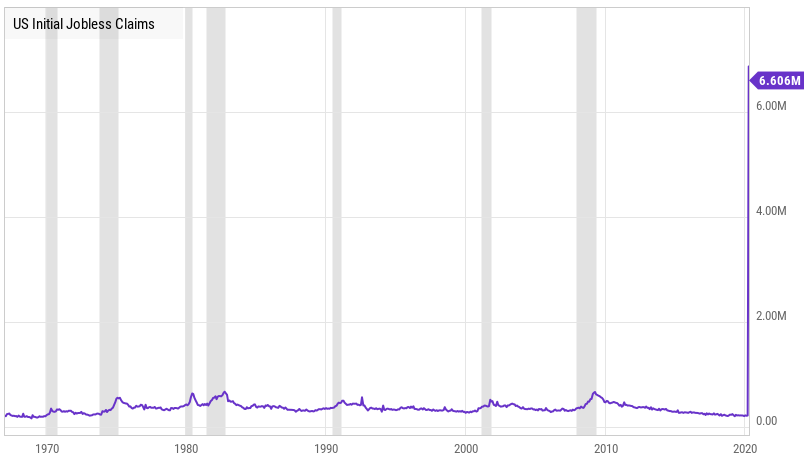

Economic numbers for March began to come in, and they are terrible. Initial jobless claims soared to between 5.2 and 6.9 million in each of the past three weeks – by far the largest job losses on record. In four weeks, we lost 13.4% of the entire US workforce of 164.6 million. Such a massive loss of jobs has never happened before – we’re in uncharted territory.

Initial Jobless Claims

Initial jobless claims soared to between 5.2 and 6.9 million in each of the past three weeks – by far the largest job losses on record.

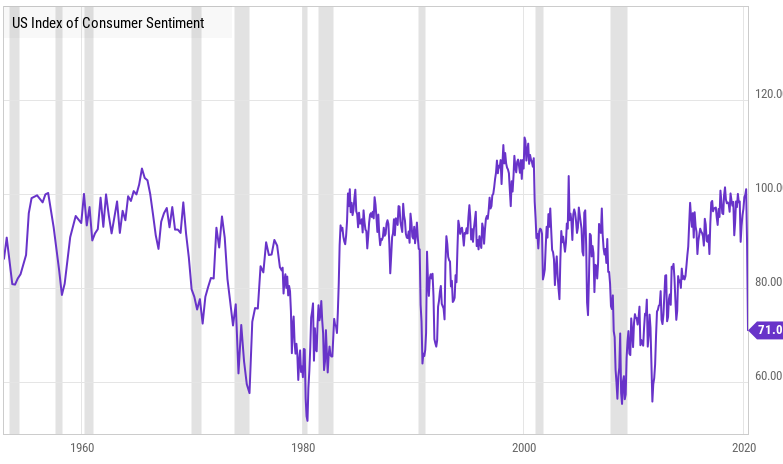

Consumer confidence has begun to decline. The University of Michigan’s sentiment dropped to 71 in April, the first consumer survey since widespread quarantines were enacted. While it’s only the lowest level since 2011, it’s nonetheless a recessionary level – and the biggest one-month drop on record.

The University of Michigan’s sentiment dropped to 71 in April, the first consumer survey since widespread quarantines were enacted and the lowest level since 2011.

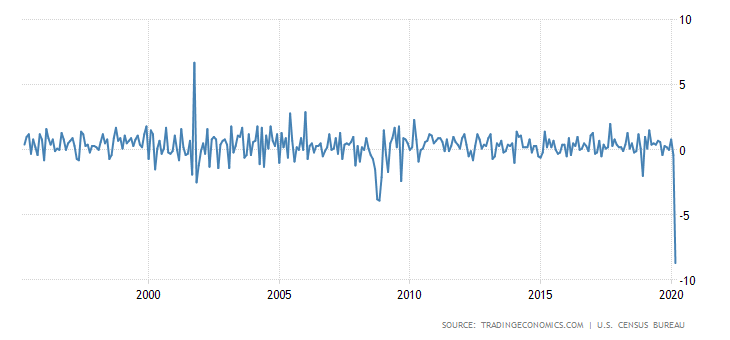

Retail sales plunged 8.7% month-over-month in March, worse than market forecasts of an 8% drop, and the biggest decline since records began in the early 1990’s.

Retail sales plunged 8.7% month-over-month in March, the biggest decline since records began in the early 1990’s.

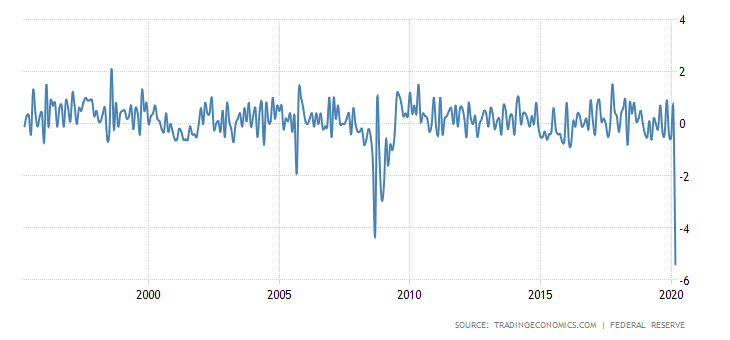

Industrial production slumped 5.4% from a month earlier in March, the largest drop since 1946 and compared with market expectations of a 4% drop.

Related: The COVID-19 Impact on Retirement Savings of Americans