When will investors learn? Complex investment bets often don’t end well.

To highlight this point, a new study by the Pioneer Institute states that the Boston based MBTA transit system’s use of financial derivatives was “reckless.”

Yes, a strong word, but unfortunately it might be well deserved.

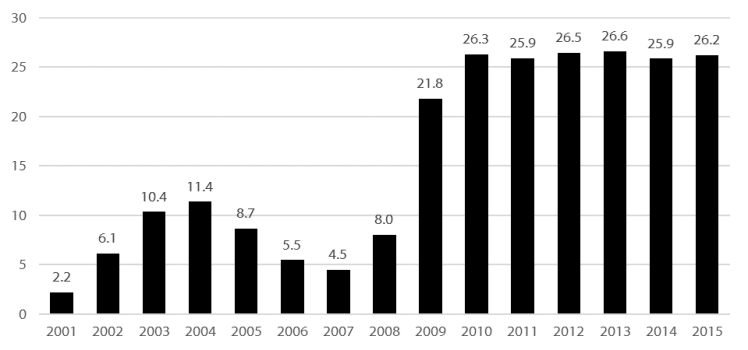

According to the report, “Despite warnings by the state auditor in 2008” about the risks of complex derivative transactions, the Massachusetts Bay Transportation Authority (MBTA) lost “an estimated $236 million” in complex transactions with investment counterparties between 2001 and 2015, which includes approximately $26 million per year on average over the last 6 years (see the below chart).

Estimated Annual MBTA Projected Swap Payments (Losses) FY 2001-2015

Source: MBTA, Federal Reserve Bank of St. Louis, SIFMA

All stories have two sides, but the data presented by Pioneer make me think about the following questions, which, even though they might come in for criticism, I am willing to risk answering:

On this last point, research studies consistently show that Wall Street, and even Federal Reserve, projections are consistently off the mark and overly optimistic. As I have written about on my company blog, financial analysts are rarely in doubt but often wrong (for more on this click the following: Talking Heads & Groundhog Day ).

To end this where I started, when will investors learn?

I am not sure, but especially in the arena of public funds, shouldn’t the public demand that our fiduciaries adhere more closely to what the evidence suggests?

Study and after study, and top investors such as Warren Buffett*, suggest that low cost, keep-it-simple investing solutions perform just as well, if not better, than complex strategies (see below for links to some of Buffett’s advice and, if you have time, take a look at the educational video below from Khan Academy ).

History also teaches us that investment derivatives and multi-factor bets sold by Wall Street to both public and private investors often don’t turn out so well (if this doesn’t sound familiar, go see the movie or read the book The Big Short ).

Instead of investing our public dollars based on fancy and on what are, in my experience, often opaque presentations from conflicted counterparties, shouldn’t the stewards of public funds only invest in what they fully understand and avoid competitive bets with big investment banks?

How about stepping back from the excitement of New New Thing investments, resisting the urge to invest public or private funds in a competitive betting manner, and remembering that, as with many things in life, the boring tortoise often beats the hare.

* Warren Buffett has repeatedly discussed the evidence in favor of index funds and warned against the use of derivatives: