Waiting until your 80’s to buy life insurance is never a great idea. With that being said, there still are some options available at your age.

You may also want to know if you can still get affordable life insurance in your 80’s. That depends on what you consider affordable. It won’t be as cheap as if you bought it in your 20’s, but that doesn’t mean you can’t secure a policy at a decent cost.

Before you start trying to find a policy, there are some essential things you need to know. We will cover each of them in this article.

Can you qualify?

The first and most important question any 80 years old should ask before trying to get a life insurance policy is this…

CAN YOU QUALIFY?

Insurance companies have specific underwriting guidelines that have to be met before you can get approved for a policy.

How do you know what the guidelines are?

The underwriting guidelines are determined by the product type you want, coverage amount you choose, and the carrier you apply with.

You can see the health questions asked on the application for burial policies below.

If you can not qualify for a burial policy you can opt for a guaranteed issue policy.

Term life insurance in your 80’s

There are still term life insurance options if you are 80 years old. However, if you are 81 or older, there are no term life options available.

The average life expectancy of a male is 86, and a female is 88. Life expectancy increases as you make it past age 65 and so on.

So if you have a term policy that only lasts until age 90, you could easily outlive the policy.

That means you will have paid in 10 years worth of premiums and have no coverage once the term expires.

There are several pros and cons of choosing a term life insurance policy at age 80. See them below.

Pros:

- It has a lower premium than whole life or a universal life policy

- You can buy higher death benefit amounts vs. burial policies

Cons:

- The longest term you can buy is for 10 years

- You can outlive the term and have no coverage

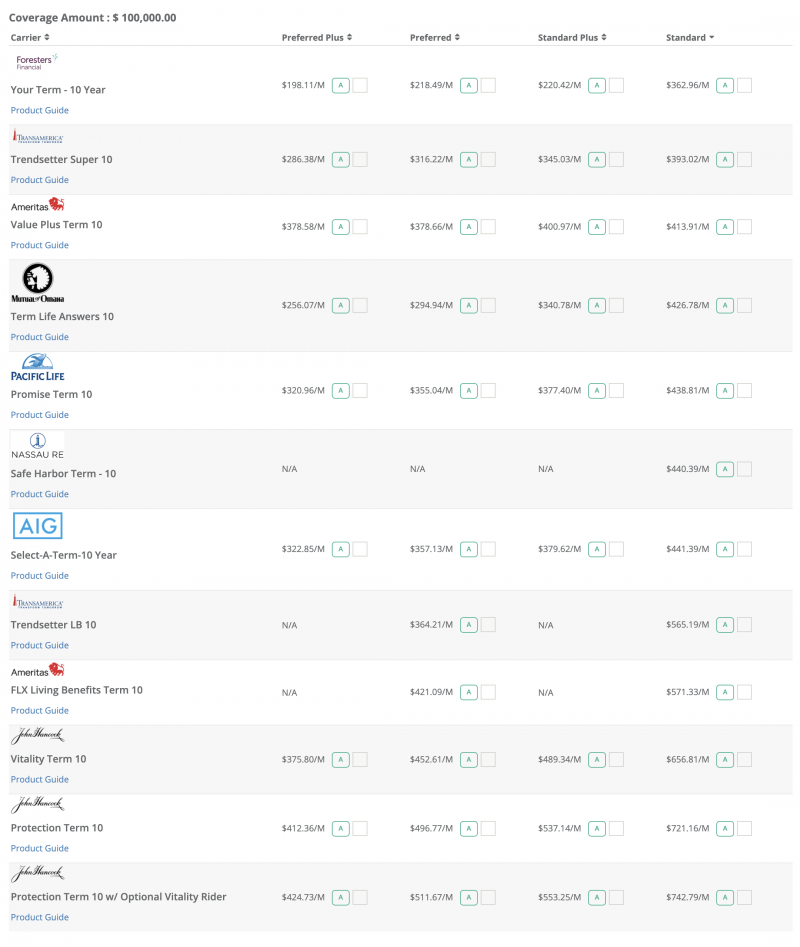

List of companies that offer term policies to 80-year-olds

- Foresters

- Transamerica

- John Hancock

- Pacific Life

- Mutual of Omaha

- AIG

- Ameritas

You can see in the image below what the results look like when you run a quote on our quote engine. You can see each rate class along with the price. We have made it very simple to compare rates from the best carriers in the county.

Whole life insurance in your 80’s

Whole life insurance is an option for anyone up to age 85. All burial and final expense plans are whole life insurance policies. These types of plans build small amounts of cash value and will last your entire life.

Two good things about whole life insurance are that the policy never expires like term insurance. Plus, the death benefits and premiums remain level for the life of the policy.

Burial insurance in your 80’s

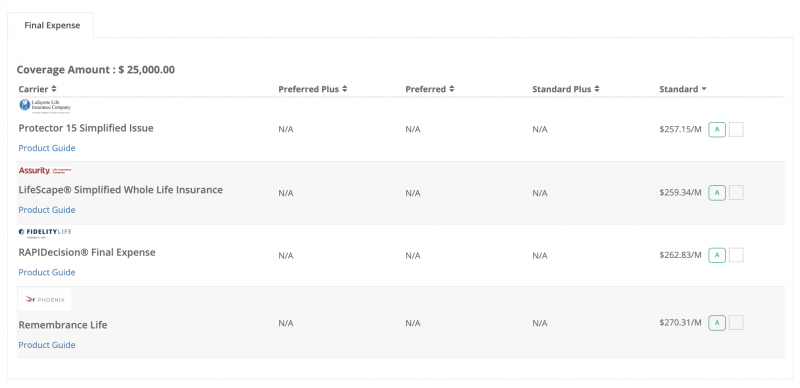

There are a handful amount of companies that offer burial life insurance in your 80’s. Most of the burial insurance companies provide coverage up to age 85 years old, with a maximum coverage amount of $25,000.

A burial insurance policy will not require an exam; however, there still is underwriting involved. The underwriting will consist of running an MIB report, RX report, and MVR.

There will also be health questions that need to be answered on the application.

You can see sample health questions from a carries app below

1. Have you ever tested positive for exposure to HIV (Human Immunodeficiency Virus) or been diagnosed as having or been treated for AIDS (Acquired Immunodeficiency Syndrome), ARC (AIDS-Related Complex) or any other immune deficiency disorder? *

2. Does the proposed insured need any assistance performing any regular activities of daily living (ADLs) such as eating, bathing, dressing, walking, toileting, or taking medications? *

3. During the past 24 months, has the proposed insured been diagnosed as having, or been treated, or taken medication for:

a. Alzheimer’s disease, dementia, epilepsy, paralysis, or any disease or disorder of the nervous system; melanoma, leukemia, or other cancer, liver disease including cirrhosis, chronic obstructive pulmonary disease (COPD), connective tissue disease, lupus, kidney failure, kidney dialysis, renal insufficiency or any disorder of the blood?

b. Heart attack, stroke, congestive heart failure, irregular heart rhythm, pacemaker implant or any procedure to improve circulation to the heart or brain?

c. Alcohol or drug abuse?

d. Diabetes requiring insulin, diabetic complications, a diabetic coma or insulin shock?

4. Has the proposed insured had any type of amputation caused by disease or any type of organ transplant? *

5. During the past 12 months has the proposed insured used oxygen equipment to assist in breathing, or rejected advice from a licensed member of the medical profession to have any type of medical test, surgery, or admission to a hospital or nursing facility except those tests related to the Human Immunodeficiency Virus(HIV)?

6. During the past 6 months has the proposed insured been declined for life or health insurance, been a patient in the hospital for two or more days, or been admitted to a nursing facility, extended care or assisted living facility?

Is there life insurance over 80 with no medical exam? Yes. Most burial policies will not require you to take an exam.

The term life options above could require an exam, especially if you are looking for coverage amounts over $100,000. Each carrier has its own requirements, which we can help you navigate.

When you shop with our tools you will see rates that look like this for burial insurance.

Life insurance options over age 85

We don’t have any carriers who offer life insurance over the age of 85, so we will not be able to recommend any carriers. There may be options for you; we just don’t have any at this time.

Conclusion

Life insurance for people in their 80’s is still an option. The three things you have to know is.

1. Can you qualify (easier to be eligible for burial insurance vs. term)

2. Do you want term or whole life

3. Can you risk outliving a term policy