Opportunity Zones (O-Zones) are a unique product of the 2017 Tax Cuts and Jobs Act (TCJA). Since being introduced, opportunity zone investments (OZs) have been a hot topic for potential tax planning. So much so, it’s been reported that Qualified Opportunity Funds have raised over $6.7 billion thru December 2019, a number that grew at a rapid pace at the end of 2019 as taxpayers looked for ways to defer capital gains.

When it comes to O-Zone, tax breaks are the headliner, but the actual underlying investment within the Opportunity Zone shouldn’t be overlooked. Questions investors should ask include:

- Where am I investing my money?

- Are there enough good investment opportunities in this space?

- Will the tax benefits be significant enough to outweigh an under-performing investment?

- Would the investor be better off just paying the tax and re-investing in an investment of their choosing?

In this blog post, we’re going to dive into Opportunity Zones, which can be a hybrid tax planning and investment solution for those that have recognized a large capital gain. We’ll define the basics of the Opportunity Zones, discuss the tax benefits, compare O-Zones to other types of investments, and explore the characteristics of an investor that might consider an investment in a Qualified Opportunity Zone.

What is an Opportunity Zone?

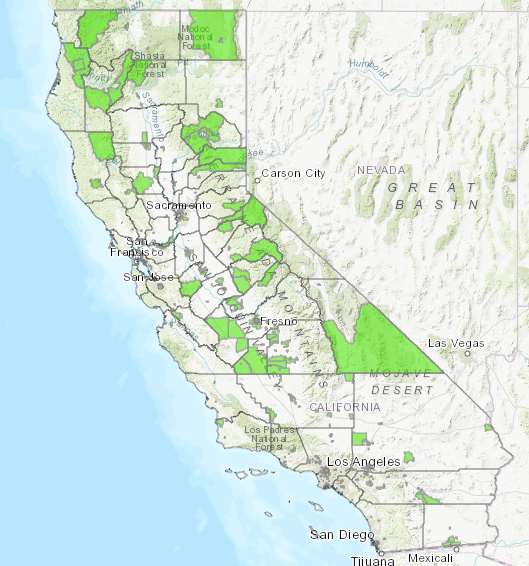

The Tax Cuts and Jobs Act of 2017 brought about a new type of investment offering, Opportunity Zones, which provide a unique way of mitigating capital gains tax. The Opportunity Zones were created to incentivize investment of capital gains into low income or economically distressed communities. By investing in these communities, taxpayers may be allowed to defer capital gains when investing funds into a Qualified Opportunity Fund (QOF) and meeting other requirements.

Check out the California Opportunity Zone map here.

What is a Qualified Opportunity Fund (QOF)?

A Qualified Opportunity Fund is an investment vehicle that files either a partnership (Form 1065) or corporation (Form 1120/1120S) federal income tax return and is organized for the purpose of investing in Qualified Opportunity Zone property.

What are the tax benefits of investing in a QOF?

There are three main categories for the tax benefits:

- Deferral of a Capital Gain

- Step-up in Basis of the deferred gain amount

- Tax free gain on new Qualified Opportunity Fund growth

Deferral of Capital Gain

When a capital gain is recognized on the sale of an asset, you have the option to take any part of the capital gain and re-invest the proceeds into a Qualified Opportunity Fund (QOF). If the capital gain proceeds are re-invested into a QOF within 180 days of the gain being recognized, the dollar amount invested will be eligible for deferring the capital gain until the earlier of:

- The tax year when the QOF interest is sold

- Or December 31, 2026

At that time, the capital gain amount that was initially deferred when proceeds were invested into the QOF, would be recognized (less any step up in basis, see below) and taxes will be paid. The capital gain tax rate will be based on the tax rate applicable during the year the gain is eventually recognized.

Step-Up in Basis

If the investment in the QOF is held for at least 5 years, there is a 10% step-up in the basis of the deferred capital gain. If the QOF investment is held for 7 years, there is an additional 5% step-up in basis of the deferred capital gain (for a total of 15%). For those investing in 2020 and beyond, there will not be a 5% step up since it will be impossible to reach the 7-year holding period by 2026.

Tax free growth

If the interest in a QOF is held for 10 years or more, the post-acquisition gains in the QOF will be excluded on the sale of the QOF interest, thereby completely avoiding capital gains tax on this portion of the gain. There are several tax incentives that could be a big win for the long-term investor. However, taxes alone should never drive an investment decision, so let’s review a few of the primary risks associated with investing in a Qualified Opportunity Fund.

Risks Abound

The TCJA just put Opportunity Zones on the map in 2017, and as recent as December of 2019, the IRS published its final regulations on Opportunity Zones. The Qualified Opportunity Funds are new vehicles and due diligence is paramount. Investors will be facing questions of operator risk, investment risk, and illiquidity risk to name a few.

- Operator risk- There won’t be an extended track record for any of the funds or operators. Are they putting the money to work in good opportunities that will net investors a positive return? Are they operating in compliance to meet the requirements of a Qualified Opportunity Fund?

- Investment risk- While the Opportunity Zone rules do encourage more than just real estate development, it is likely that a lot of early projects will be in real estate development. Any real estate development project carries its own risks, not to mention that the developments will be located in Opportunity Zones, which by design are designated as an economically distressed area. As such, investing in these areas could carry additional risk(s) and expectation of returns should be scrutinized closely. Depending on the QOF, there could be single property risk if the fund has only invested in one project versus others that plan to invest in multiple projects.

- Illiquidity – depending on the fund, the investment could be illiquid. To capture the tax benefits and defer the gain the maximum number of years, you would need liquidity elsewhere. This will be a 10-year investment if you want to hit the tax trifecta (deferred gains, step-up in basis, and future tax-free growth). If holding the QOF investment for ten years, the investor would also need to set aside cash to pay the initial capital gain tax that was deferred and recognized in 2026, so plan accordingly.

Is an Opportunity Zone Investment Worth Consideration?

For comparison, we ran a hypothetical scenario to help evaluate the break-even return required by an investor that has captured a tax benefit from the Opportunity Zone (OZ) investment:

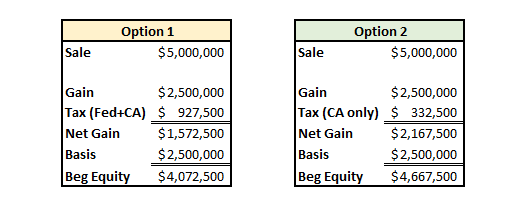

- Option 1: Recognize capital gains on an investment, pay tax on those gains for Federal and California (assuming a California tax payer), and reinvest all the net proceeds (gain and basis) into a new investment

- Option 2: Recognize capital gains on an investment, pay tax on those gains for California only, and reinvest the net gains in a Qualified Opportunity Fund while putting the basis in a new investment

It’s clear the Opportunity Zone investor has the beginning advantage with more capital to invest in year 1 (Option 2). A larger starting investment can compound at lower rates of return and still arrive at the same future dollar amount over 10 years. But, how much lower can the return be for the tax advantaged investor before the lackluster investment performance wipes out the tax advantages?

The goal here was to find the break-even return required from an Opportunity Zone fund to put the investor on par with just paying the tax and re-investing.

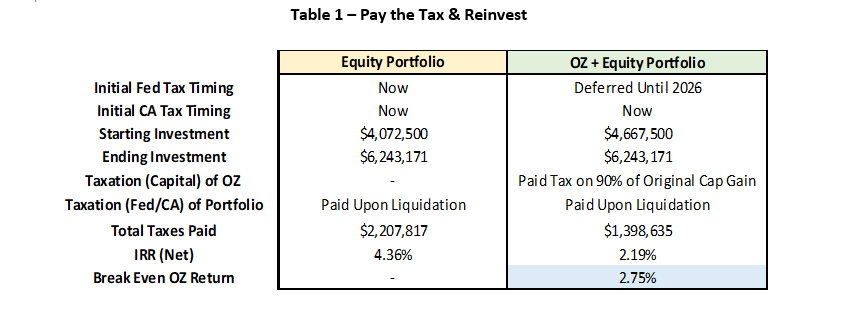

For the first scenario (Table 1), we assumed the investor paid the tax and re-invested the remaining proceeds into an equity portfolio with an expected return of 6.33% (see Capital Market Assumptions Blog). The Opportunity Zone investor invested the gain portion into a QOF and the basis in an equity portfolio. Assumptions are that all investments are liquidated at the end of ten years. The numbers are as follows:

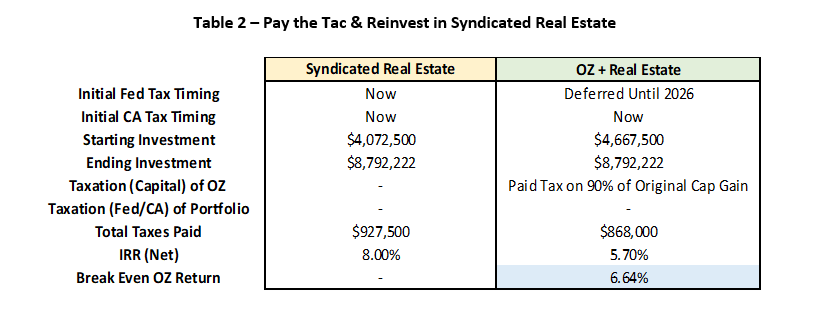

For the second scenario (Table 2), we assumed the investor paid the tax and re-invested the net proceeds into syndicated real estate that is expected to return 8%. The real estate investment has additional tax deferral options at the end of the ten-year holding period. It is still assumed that both options are liquidated at the end of ten years. The breakdown comparison of the options are shown below:

The QOF has merit when compared to paying the taxes and investing in an all equity portfolio. The break-even return required in the QOF of 2.75% (see Table 1) gives the investor a nice cushion provided by the tax savings. However, for accredited investors with the options to place funds within more sophisticated investment vehicles, the results become more convoluted. The QOF investor would require a break-even rate of return at 6.64% which is a much higher hurdle for an Opportunity Zone investment that carries many additional risks outlined earlier.

Conclusion

Let’s summarize where the Opportunity Zone seems to be an optimal solution.

At minimum, it’s an investor that has recognized or will be recognizing a significant capital gain. If the investor:

- Has liquidity elsewhere to allow for a 10-year investment horizon in a QOF and liquid assets to pay the deferred tax due in year 2026

- Would like to diversify a portion of their portfolio to real estate

- Desires to invest money within economically disadvantaged areas for community/social benefits

Based on the comparison we modeled, if the motivation is strictly financial, an accredited investor in California (zero state tax benefits) with access to private syndicated real estate investment opportunities might just consider paying the tax and investing in a lower risk real estate investment. Instead of investing money in projects requiring development, existing properties with current cash flows may be a lower risk option.

Of the tax incentives, the ‘tax free’ growth on a new investment in an Opportunity Zone sounds appealing. However, real estate investments already allow for significant tax efficiency. Real estate investors can defer unrealized gains in future 1031 (IRC Section 1031) exchanges and heirs of real estate property receive a step up in cost basis at death.

In addition, certain types of real estate investments also allow investors to utilize depreciation to shield income from taxation; until exhausted or exchanged into a new property via 1031 exchange.

Given the existing tax efficiency and opportunity to invest outside of economically disadvantaged areas, private syndicated real estate has the potential to outperform a higher risk Opportunity Zone investment in the long run.

If you’ve incurred or will be incurring a significant capital gain and need help evaluating your options, contact Centura Wealth Advisory for a consultation.

Related: The Organizations That Will Emerge Stronger From This Crisis

References:

https://www.irs.gov/newsroom/opportunity-zones-frequently-asked-questions