Written by: Chris Broussard | Mid Atlantic Capital Group

Mid Atlantic 401(k) Benchmark Reflects COVID-19 Impact on Retirement Savings of Americans

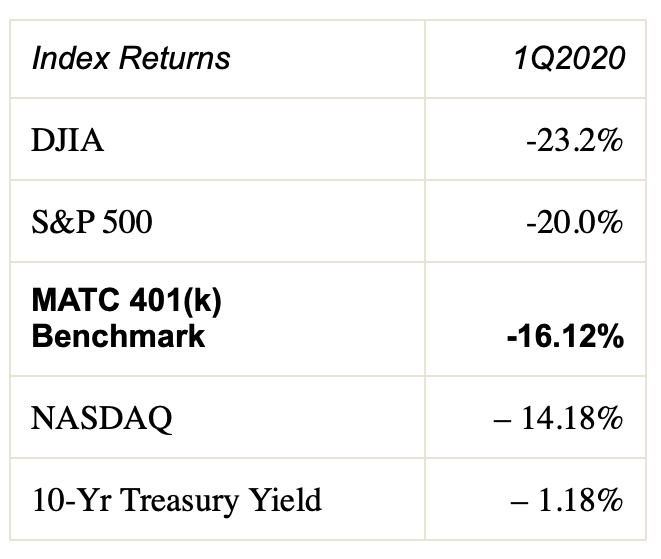

The Mid Atlantic Trust Company 401(k) Benchmark, which reflects the portfolio performance across 401(k) plans serviced by the company, finished the first quarter of 2020 with a -16.12% trailing return. The 16.12% decline for the quarter comes on the heels of a +6.13% return for the fourth quarter of 2019 and an overall return of +21.24% for the calendar year 2019.

The performance of the 401(k) Benchmark is in line with the trajectory of the major market indices amidst the world’s response to the Coronavirus pandemic.

Six weeks into 2020 all of the major indices reached all-time highs, but quickly retreated from those lofty levels during March as the economic impact of the pandemic began to take hold. The Dow Jones Industrial Average (DJIA) posted a drop of -23.2% for the first quarter, its worst quarter since the fourth quarter of 1987. The S&P 500 posted a -20% change for the quarter — its worst overall quarter since the fourth quarter of 2008. The NASDAQ Composite Index finished the first quarter of 2020 posting a -14.18% return, its worst since 2018.

As the equity market performance shifted in the first quarter of 2020, the shift in asset allocation across 401(k) plans is reflected in the 401(k) Benchmark. The allocation of U.S. Stock holdings dropped from 57% of holdings at the end of Q4 2019 down to 52% at the end of Q1 2020. Non-U.S. stocks stood firm at 18% in a quarter-over-quarter comparison, while Cash, U.S. Bonds and Non-U.S. Bond holdings saw an uptick in total holdings.

For a copy of the full report of the Mid Atlantic Trust Company 401(k) Composite Benchmark, click here.