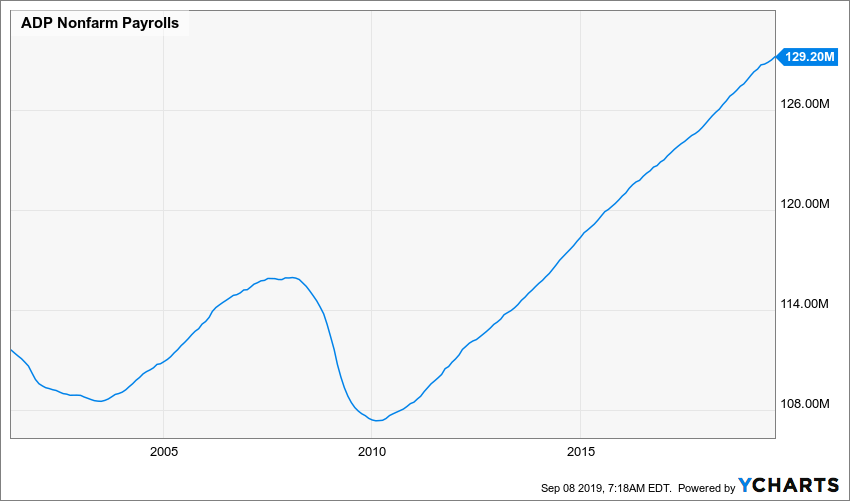

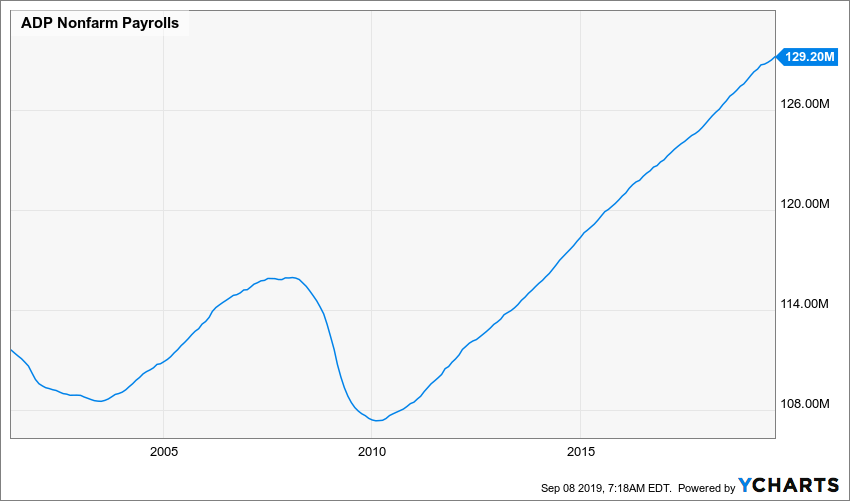

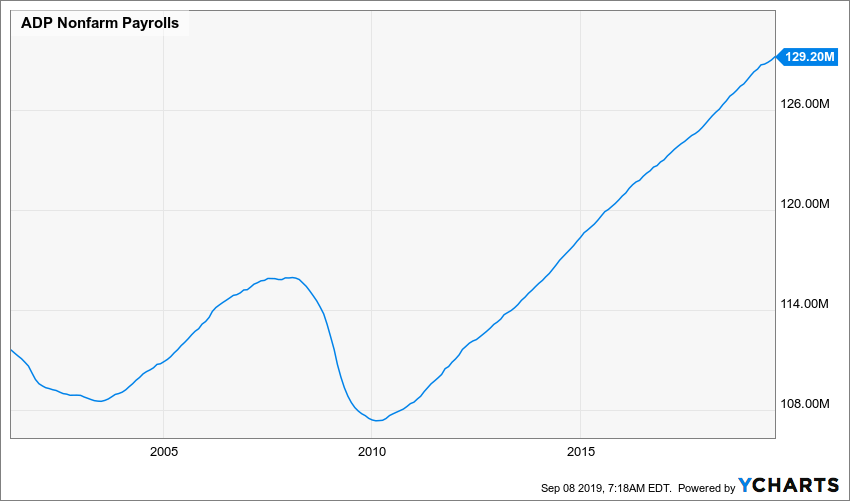

The economic releases were consistent with a slowing economy in August, with the manufacturing ISM cracking below the 50 level (contraction) and the BLS jobs report coming in at 130,000 versus an estimate of 158,000. Neither of those reports should be cause for alarm, in a fact with a longer-term perspective the jobs data remains very positive:

Whereas a sub-50 in the ISM report suggests contraction, it is also quite a normal ebb and flow. Most recently the period between October 2015 through January 2016 were also in the high 40s. Those readings get significantly worse during recessions.

In any event, those economic releases were innocuous enough to allow the tone of the “trade war” to continue to dictate the direction of the market. The imposition of additional tariffs over the holiday weekend resulted in selling pressure on Tuesday morning, but later in the week the news that the U.S. and China had set a date in October to go back to the bargaining table triggered a rally that left the S&P 500 in the green by 1.8% by Friday’s close. Small caps fared worse, with the Russell 2000 only gaining 0.69%. The yield on the Ten-Year Treasury inched up 4 basis points to 1.55%, while the dollar declined 0.5%.

Tough season opening loss for the Chicago Bears. At least we made a field goal without hitting the uprights.

This Week:

The twists and turns of the trade war narrative will likely still influence trading, however it is worth noting those swings continue to be shorter and shallower as the story grows old. On Thursday the ECB is likely to cut rates 10 basis points as well as recommence some form of quantitative easing. Also on Thursday the BLS releases its consumer price index for August which is expected to show a 2.3% increase in the core CPI. A reading hotter or colder than expectations could influence Fed policy on interest rates. On Friday the University of Michigan reports its Consumer Sentiment Index for September. The forecast call for a rebound to 91 from August’s 89.8 figure, which was the weakest reading since 2016.

Stocks on the Move:

(COHR) +13.83%: Coherent Inc supplies photonics-based solutions for commercial and scientific research applications. Since the Company derives half its revenue in Asia, its share price movement has been closely linked to the tone of the trade narrative. COHR is a 1.06% holding in the North Star Opportunity Fund.

(LEAR) +10.2%: Lear designs, develops, and manufactures automotive seating and electrical systems and components. The global automotive slowdown has hit LEAR shares hard this year, driving it to a low enough price that bargain hunters finally jumped in. LEAR is a 1.07% holding in the North Star Opportunity Fund.

(MDP) -21.21%: Meredith Corp is an American media company that focuses on publications and marketing services around the home, family, food, and lifestyle markets. The Company reported solid results for their first fiscal year since completing the acquisition of Time Inc., as total company revenues from continuing operations grew more than 40% to $3.2 billion. Earnings from continuing operations were $129 million compared to $114 million and excluding special items in both periods, earnings from continuing operations increased more than 50% to $223 million. Adjusted EBITDA grew 67% to $706 million. The forward guidance, on the other hand, was quite disappointing, as they acknowledged that the results from the Time Inc. acquisition were below expectations. MDP is a 1.41% holding in the North Star Opportunity Fund.

(NSSC) -23.7%: NAPCO Security Technologies Inc manufactures security products, encompassing access control systems, door-locking products, intrusion and fire alarm systems and video surveillance products. “Fiscal 2019 saw NAPCO reaching new heights in both sales and profitability,” Chairman Richard Soloway said in a statement. “I am particularly pleased with our Company continuing its uninterrupted string of 20 consecutive quarters of year-over-year record sales levels, as well as surpassing the $100M annual sales mark and generating net income of over $12 million.” The only modest negative was that gross margins decreased by 1% for the quarter primarily due to product mix, as well as additional sales discounts given related to several new product launches. Despite the share price decline last week, the stock is still up over 63% for 2019. NSSC is a 2.10% holding in the North Star Micro Cap Fund.

(MOV) +10.96%: Movado Group Inc designs develop, sources, markets, and distributes fine watches in the United States and internationally. The shares recouped about half of the previous week’s decline that follow a reduction in their forward guidance. MOV is a 2.98% holding in the North Star Micro Cap Fund.

Related:

Have Trade War Tweets, Soundbites and Other Headlines Become Leading Market Indicators?

Whereas a sub-50 in the ISM report suggests contraction, it is also quite a normal ebb and flow. Most recently the period between October 2015 through January 2016 were also in the high 40s. Those readings get significantly worse during recessions.

In any event, those economic releases were innocuous enough to allow the tone of the “trade war” to continue to dictate the direction of the market. The imposition of additional tariffs over the holiday weekend resulted in selling pressure on Tuesday morning, but later in the week the news that the U.S. and China had set a date in October to go back to the bargaining table triggered a rally that left the S&P 500 in the green by 1.8% by Friday’s close. Small caps fared worse, with the Russell 2000 only gaining 0.69%. The yield on the Ten-Year Treasury inched up 4 basis points to 1.55%, while the dollar declined 0.5%.

Tough season opening loss for the Chicago Bears. At least we made a field goal without hitting the uprights.

Whereas a sub-50 in the ISM report suggests contraction, it is also quite a normal ebb and flow. Most recently the period between October 2015 through January 2016 were also in the high 40s. Those readings get significantly worse during recessions.

In any event, those economic releases were innocuous enough to allow the tone of the “trade war” to continue to dictate the direction of the market. The imposition of additional tariffs over the holiday weekend resulted in selling pressure on Tuesday morning, but later in the week the news that the U.S. and China had set a date in October to go back to the bargaining table triggered a rally that left the S&P 500 in the green by 1.8% by Friday’s close. Small caps fared worse, with the Russell 2000 only gaining 0.69%. The yield on the Ten-Year Treasury inched up 4 basis points to 1.55%, while the dollar declined 0.5%.

Tough season opening loss for the Chicago Bears. At least we made a field goal without hitting the uprights.

Whereas a sub-50 in the ISM report suggests contraction, it is also quite a normal ebb and flow. Most recently the period between October 2015 through January 2016 were also in the high 40s. Those readings get significantly worse during recessions.

In any event, those economic releases were innocuous enough to allow the tone of the “trade war” to continue to dictate the direction of the market. The imposition of additional tariffs over the holiday weekend resulted in selling pressure on Tuesday morning, but later in the week the news that the U.S. and China had set a date in October to go back to the bargaining table triggered a rally that left the S&P 500 in the green by 1.8% by Friday’s close. Small caps fared worse, with the Russell 2000 only gaining 0.69%. The yield on the Ten-Year Treasury inched up 4 basis points to 1.55%, while the dollar declined 0.5%.

Tough season opening loss for the Chicago Bears. At least we made a field goal without hitting the uprights.

Whereas a sub-50 in the ISM report suggests contraction, it is also quite a normal ebb and flow. Most recently the period between October 2015 through January 2016 were also in the high 40s. Those readings get significantly worse during recessions.

In any event, those economic releases were innocuous enough to allow the tone of the “trade war” to continue to dictate the direction of the market. The imposition of additional tariffs over the holiday weekend resulted in selling pressure on Tuesday morning, but later in the week the news that the U.S. and China had set a date in October to go back to the bargaining table triggered a rally that left the S&P 500 in the green by 1.8% by Friday’s close. Small caps fared worse, with the Russell 2000 only gaining 0.69%. The yield on the Ten-Year Treasury inched up 4 basis points to 1.55%, while the dollar declined 0.5%.

Tough season opening loss for the Chicago Bears. At least we made a field goal without hitting the uprights.