Many feel they don’t have the money they need to invest, so they forego savings altogether. Sound familiar?

If this is you, the time has come for you to stop shooting yourself in the foot, and start saving today. Consistency while saving is key, and can make all the difference over time. Each dollar that you contribute to your portfolio adds up. In the long run, your investments early on can make a real impact, and when the time comes to withdraw your hard earned savings, the interest you’ve earned on your investments will help to provide a comfortable retirement or any long term goal you might be saving towards.

Start Saving Now

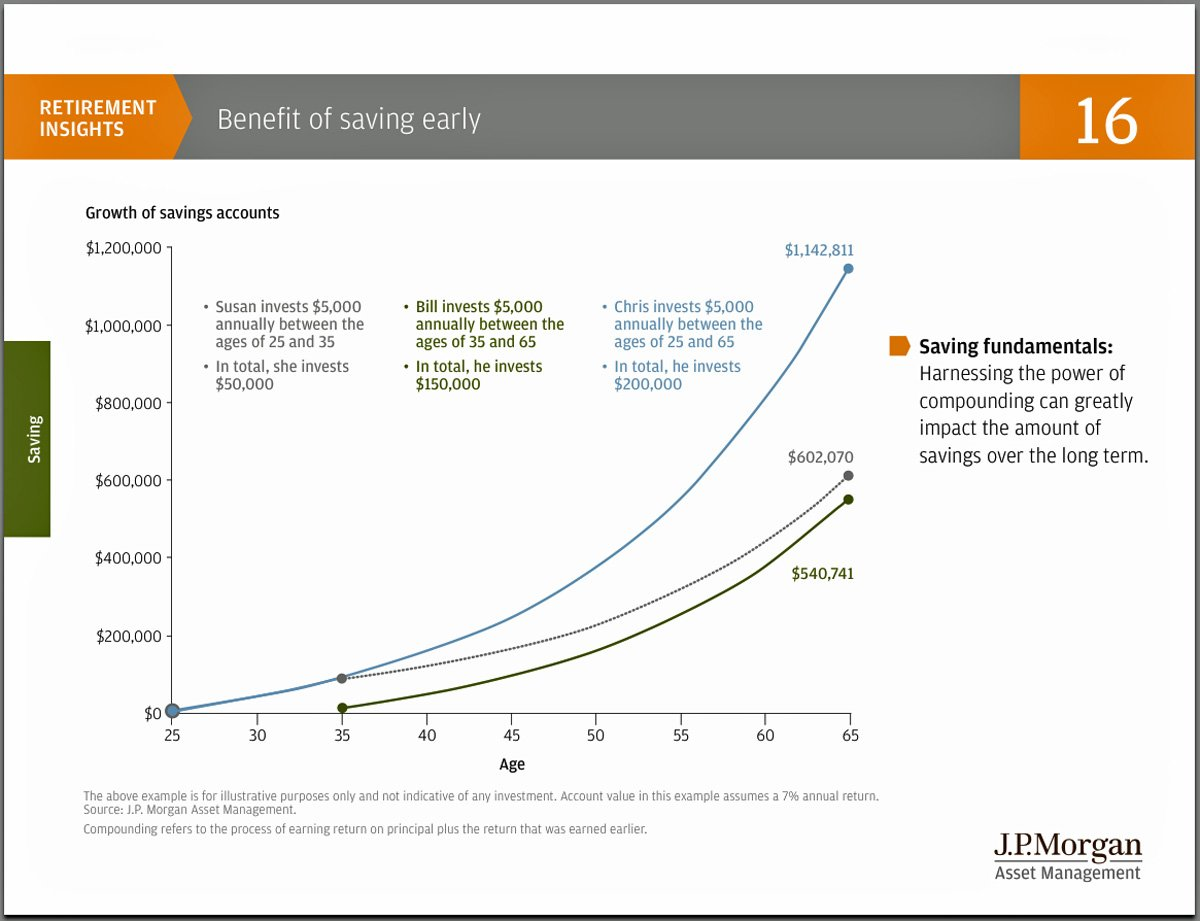

Consider the difference of waiting to begin saving. At age 27 you will need to put away $214 a month to reach a goal of $1 million. When you start at age 37, you will need to put away $541 a month to reach your goal. If you wait until age 47, that number rises to $1,491 a month and if you wait until age 57, you’ll need to put away a hefty $5,168 a month. Waiting until the last minute (age 62) would mean having to stash $13,258 a month to reach $1 million by the age 67 – ouch!

When you factor in things like compound interest, the negative impact of delaying your retirement savings becomes increasingly obvious. Compound interest is often compared to a snowball. If a 2-inch snowball starts rolling, it picks up more snow, enough to cover its tiny surface.

As it keeps rolling, the snowball grows, so it picks up more snow with each revolution. If you invest $1,000 in a fund that pays 8% annual interest compounded yearly, in 10 years you’ll have $2,158.93, in 20 years that will be $4,660.96, in 30 years it will be $10,062.66, and in 40 years it will be $21,724.52. It takes patience, but with time you can turn $1,000 into $21,724.52. That sounds like a lot of money, but if we’re being realistic, $1,000 is often spent on:

• A weekend skiing with friends

• A few months of dining out with friends or your spouse

• A new piece of furniture, or tech that you may/may not need

By hitting “pause” on these non-essential goals, you can easily start saving today and take advantage of compound interest.

No matter where you are right now, the crucial point is to begin putting money aside immediately to achieve your long-term financial goals.

What are your future goals?

Travel? Education for your kids? Paying off your mortgage?

Even when you contribute a minimal amount annually, if you’re consistent with that contribution over many years, the growth your investment will make can maximize your wealth in the long ron.

The idea that you don’t have enough money right now to make your investment worthwhile is hurting you and your future. Resist the urge to overthink how much you are investing, and just act by giving what you can to your future savings today. Remember: every dollar counts, and the satisfaction of watching your investment grow over time will give you peace of mind and a freedom to plan for the future.

Don’t Jump Ship When Things Go South

Many investors view themselves as being rationally-minded individuals who don’t take sudden action when the markets become turbulent. Too often, though, people do try to time the markets, and wind up making a wrong decision as a result.

Derek Horstmeyer of the Wall Street Journal writes “Most investors think of themselves as rational and immune from the behavioral elements that periodically roil markets. Human factors, however, do continue to affect our personal portfolio decisions—usually to the detriment of our long-run returns.”

Thinking too much about the “perfect timing” when growing our portfolios is a strategy that will more often than not cause people to lose money in the long run. A far better investment plan is to focus on the big picture, and less on a perfect portfolio – where every decision is made at the exact right time.

Timing the market is less important than time in the market, and getting caught up in getting that “perfect timing” is almost certain to cost you money. Aiming toward a good, solid return on your investment is a smarter strategy than worrying about every detail affecting your portfolio. All too often, people panic as soon as things start to go south (pulling out when the market has already hit bottom and putting in more when at the top). As a result, they often don’t experience this stated return in full. By resisting this urge to make a rash decision, investors showing behavioral restraint may actually wind up saving 1-2 percentage points a year.

Starting early is a critical component to a successful portfolio. It is never too late (or too early) to start, so the sooner the better. Beginning in 2011, studies were conducted where participants were shown a computer generated rendering of what they might look like at their age of retirement. They were then asked to make financial decisions about whether to spend their money today or save that money for the future.

In each study, those individuals who were shown pictures of their future selves allocated more than twice as much money towards their retirement accounts than those who did not see the age-progressed images. Seeing the images gave the participants a connection with their future selves that they did not possess before. As a result, their saving behavior changed dramatically because, “saving is like a choice between spending money today or giving it to a stranger years from now.”

Related: Maximizing the Earning Power of Your Cash Reserves

Picture Your Retirement

Instead of viewing your future self as a stranger, think of how you actually might look. Then think of the financial decisions you are making today and how they will affect you in the future.

Are your spending and saving habits today matching up with how well that future self is able to live tomorrow? Every delay you make toward saving for retirement, or investing wisely means a further burden you will place on yourself later on. In fact, starting your retirement saving early is actually more important than earning higher returns at a later date.

The importance of starting now can’t be stressed enough. Luckily, fee-only, fiduciary advisors exist to help everyday people in making wise choices and to lessen the anxiety associated with what can seem like an overwhelming task.

The good news is you don’t even have to be a millionaire to get this customized service. Working with a professional will enable you to maximize your return on investment and tailor a savings plan just for you . Don’t delay getting started. The benefits of starting early and often far outweigh how much you actually save.